By Steven Brown

The oil sector is suffering a “demand shock” and the price will continue to change rapidly over the coming months, according to an industry expert.

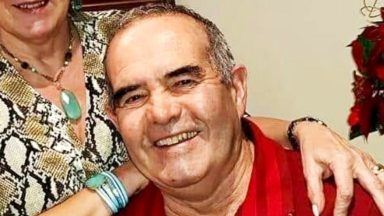

Professor Paul de Leeuw, director of Robert Gordon University’s Energy Transition Institute, said in the last four to six week there has been a “complete and utter collapse in demand”.

At the start of this year the benchmark for the oil price, a barrel of brent crude, was sitting at around $68. Now it has dropped nearer $23 – an 18 year low.

“Particularly in the last week we have almost a quarter of the world in lockdown and that takes a huge demand out of the oil sector,” said Professor de Leeuw.

‘Triple whammy’

He said that there is usually a need for around 100 million barrels a day across the world but by April and May that could fall to around 70 to 80 million.

He added: “That huge swing that is taking place on the the demand side, with over supply continuing at the same time, of course has a massive implication on the oil price.

“This is the biggest dislocation of the industry that we have seen in a very, very long time.”

He believes the Scottish and North East economy is suffering a ‘triple whammy’ – a health, economic and now oil price challenge.

The coronavirus crisis has seen world demand drop and cause uncertainty across the global markets.

Consistent drops in the FTSE 100, a cutting of interest rates to 0.1% and the need for the Chancellor to step in with a £330bn business bailout means it is a world economy that is slowly becoming more immune to such shocks.

But an oil price war between Russia and Saudi Arabia is the spark that sent the value plunging so rapidly.

The two countries couldn’t agree production levels and still the stand-off continues.

“You can see, particularly where there is a choice… when there is a choice to go ahead or not go ahead it is already stopping.”

Professor de Leeuw, Robert Gordon University

On Monday, the US stepped in and called on the two sides to come to an agreement with President Trump calling the price war “crazy”.

Suggestions on Tuesday that some firms may have so much oil they might start paying to have barrels taken away were downplayed by Professor de Leeuw.

“At the moment for most it is still better to produce than not to produce but there will be a point in time when people will shut their production because it won’t make any sense,” he said.

“You’re not going to have people not making any money and giving it away, I think that would be very exceptional.

“You can see, particularly where there is a choice, discretionary capital activity, drilling activity, project activity, when there is a choice to go ahead or not go ahead it is already stopping.”

During the height of the last oil downturn in 2016, the oil price dropped to around $28 a barrel.

Then, estimates were around 120,000 people lost their jobs and the economic impact to places like Aberdeen are still being felt.

Ross Dornan, Oil and Gas UK, said: “Many of the companies in our industry, especially in the supply chain, are still financially fragile after the previous oil price crash, so the triple whammy of the most dramatic fall in oil price for 30 years, continued low gas prices and the operational impact of the coronavirus we now face is particularly concerning.

“The UK sector remains critical for providing secure and affordable energy now, but also in providing the net zero solutions we need in future such as carbon capture and storage.

“Ensuring our industry has the support it needs is therefore not only essential for protecting that security of supply and the thousands of jobs this industry supports now, but also to Scotland and the UK’s net zero ambitions.”

A number of oil firms are now again looking at ways to save money as the coronavirus pandemic and oil price crash begins to bite.

Shell has said it expects to take a hit of up to £649m in the first quarter of this year because of the ‘significant uncertainty’ around the developing crisis.

The firm also said it would cut its operating costs by between two and just over £3bn over the coming year.

There is a glimmer of hope with the likes of Shell and BP seeing a small increase in share price in after a drop in the middle of this month.

But with analysts unable to say if the price won’t continue to fall, these next few months could be the toughest this industry has faced in decades.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country