Chancellor Rachel Reeves will likely have to raise taxes as part of “substantial” action needed at the autumn budget to plug a £51 billion black hole in the public finances, a major economic think tank has warned.

The National Institute of Economic and Social Research (Niesr) said weaker-than-expected recent economic activity, U-turns on welfare cuts, and forecast-beating borrowing mean Reeves is on track to miss one of her fiscal rules by £41.2 billion in 2029-30.

It cautioned she faces an “impossible trilemma” of trying to meet her fiscal rules while fulfilling spending commitments and upholding a manifesto pledge not to raise taxes.

Including the need to rebuild the fiscal buffer of just under £10 billion that has been wiped out, she will have to find over £51 billion, according to the group.

In its latest economic outlook, Niesr said she will likely need to break her pledge not to raise taxes for working people and resort to “moderate but sustained” hikes, or cut spending, to address the shortfall.

“Substantial adjustments in the autumn budget will be needed if the Chancellor is to remain compliant with her fiscal rules,” said Niesr.

The report has fuelled speculation over how the Government may look to boost tax revenues in the autumn, including mounting rumours of a possible wealth tax.

Professor Stephen Millard, Niesr’s deputy director for macroeconomics, said: “Things are not looking good for the Chancellor, who will need to either raise taxes or reduce spending or both in the October budget if she is to meet her fiscal rules.”

Niesr said if the Government moved to extend the income tax threshold beyond 2028, it would bring in around £8.2 billion – far short of what is needed.

To fill the £51 billion black hole would require a rise in the basic and higher rates of income tax by five percentage points, according to the group.

It is recommending “gradual” tax rises and for the Chancellor to look at reforms, such as overhauling the council tax bands and possibly replacing it with a land value tax.

Culture Secretary Lisa Nandy again ruled out introducing a wealth tax in response to warnings the Chancellor could miss her fiscal targets by £40 billion.

She told Sky News: “The Chancellor has very much poured cold water on that idea, partly because many countries have tried this sort of approach, but mostly because we were elected as a government in a time when taxes on working people were at their highest rate for generations.

“We want to bring taxes down for people, we want to help support them, put money back into people’s pockets, and all the things that we’ve been doing as a government in the last 12 months have been aimed at that.”

Niesr has urged the Government to look at addressing the public finance woes by building a “large fiscal buffer via a moderate but sustained increase in taxes”.

It said: “This will help allay bond market fears about fiscal sustainability, which may in turn reduce borrowing costs.

“It will also help to reduce policy uncertainty, which can hit both business and consumer confidence.”

The Chancellor has set herself two fiscal rules – the “stability rule”, which ensures that day-to-day spending is matched by tax revenues so the Government only borrows to invest, and the “investment rule”, which requires the Government to reduce net financial debt as a share of the economy.

PA Media

PA MediaShadow chancellor Sir Mel Stride said: “Experts are warning Labour’s economic mismanagement has blown a black hole in the nation’s finances which will have to be filled with more tax rises – despite Rachel Reeves saying she wouldn’t be back for more taxes.

“Labour will always reach for the tax rise lever because they don’t understand the economy.”

Elsewhere in the report, Niesr nudged up its economic outlook for the UK, with growth of 1.3% pencilled in for 2025, up from 1.2% forecast in May.

But the group cut its prediction for next year to 1.2%, down from 1.5% previously expected.

Niesr also said the UK was in store for higher-than-forecast inflation, averaging around 3.5% this year and edging back only slightly to 3% in the second quarter of 2026.

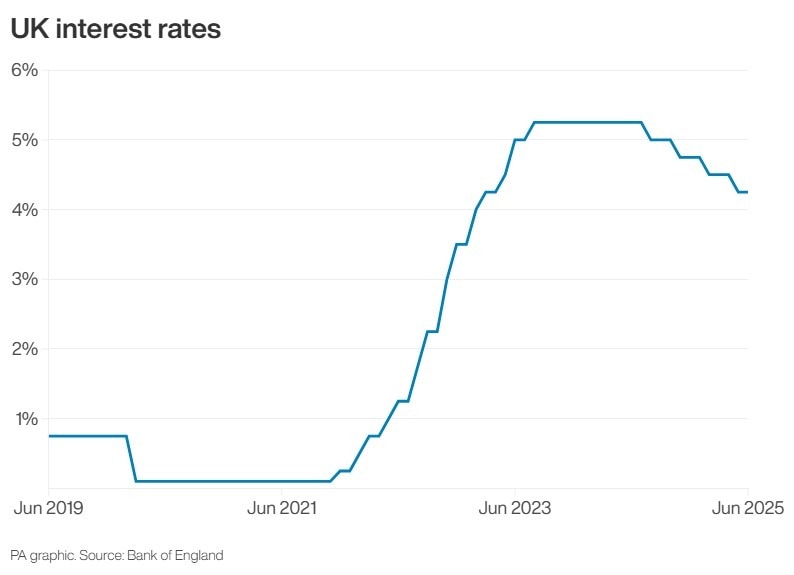

Despite the inflation pressures, Niesr expects the Bank of England to cut interest rates from 4.25% currently to 3.5% at the beginning of 2026.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

PA Media

PA Media