Betting firms are warning that proposed tax increases on the industry, backed by Gordon Brown, would “devastate jobs, undermine the economy and drive billions into the hands of the gambling black market.”

The Betting and Gaming Council (BGC) commissioned EY – a firm specialising in economic modelling that advises companies and governments on tax – to analyse the impact of a set of proposals published earlier this year by the Institute for Public Policy Research (IPPR), a think tank.

The IPPR estimates the Chancellor could raise £3.2 billion a year in her Budget if:

• Remote Gambling Duty on online slots, poker, and online bingo rises from 21% to 50%.

• Machine Games Duty on cash-prize slot machines rises from 20% to 50%.

• General Betting Duty on sports betting (excluding horse racing), online or in betting shops, rises from 15% to 30%.

Gordon Brown gave his support to the changes, arguing the money should be used to remove the cap that currently only allows families to claim benefits for their first two children.

But EY concludes the proposed tax increases would not raise anything like the sums the IPPR assumes and would have profoundly negative unintended consequences.

EY’s analysis concludes the IPPR’s plans would risk the loss of 40,000 jobs – almost half the 109,000 people currently employed directly and indirectly by the industry – as £8.4 billion of consumer spending is diverted to unregulated, unlicensed operators offering more attractive odds and prizes.

EY says the government might see just over £1 billion in extra tax in the short term but when factors such as job losses, lower corporation and National Insurance contributions, and closed betting shops are taken into account, the real gain for the Treasury could drop to less than £500 million.

Grainne Hurst, chief executive of the BGC, said: “It is now clear these further tax rises are a direct threat to British jobs and economic growth.”

The statement added: “Tax raids like those proposed would mean fewer betting shops, casinos, and bingo halls, fewer jobs, and a huge boost to the growing, unsafe gambling black market, while not raising anywhere near the tax claimed.”

EY identifies three major flaws in the IPPR report:

1. It assumes gamblers would continue to spend the same even if betting companies worsen the odds.

2. It fails to include the impact of the recent White Paper reforms, which EY argues will cut online gambling revenues by around £725 million a year.

3. It overestimates the future growth of online gambling.

Last week, BetFred warned that tax rises on the scale advocated by the IPPR would force the closure of its 1,300 betting shops, with the loss of 7,000 jobs.

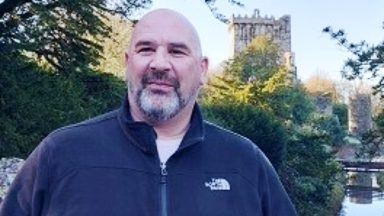

Greg Knight, who runs JenningsBet, has told ITV News he has the same concerns.

The company operates around 150 betting shops in the UK and employs just over 1,000 people. Last year, JenningsBet paid almost £17.5 million in gambling duties and levies.

“This is existential,” Knight said. “The increase in Machine Gaming Duty alone would wipe out any forecast profit this year and we would be loss-making. It’s clearly bonkers.”

In a statement, Professor Ashwin Kumar, director of research and policy at IPPR, said: “Our report is an independent, evidence-based assessment of how the gambling sector can make a fairer contribution to society. It’s no surprise that an industry lobbying group is opposed to higher taxes on its members, but their claims of potential job losses and huge increases in illegal gambling don’t stand up to scrutiny.

The statement added: “Online gambling is taxed lower in the UK than many other countries. The idea that well-designed tax reforms would undermine jobs or drive gambling offshore is not supported by the evidence.”

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country