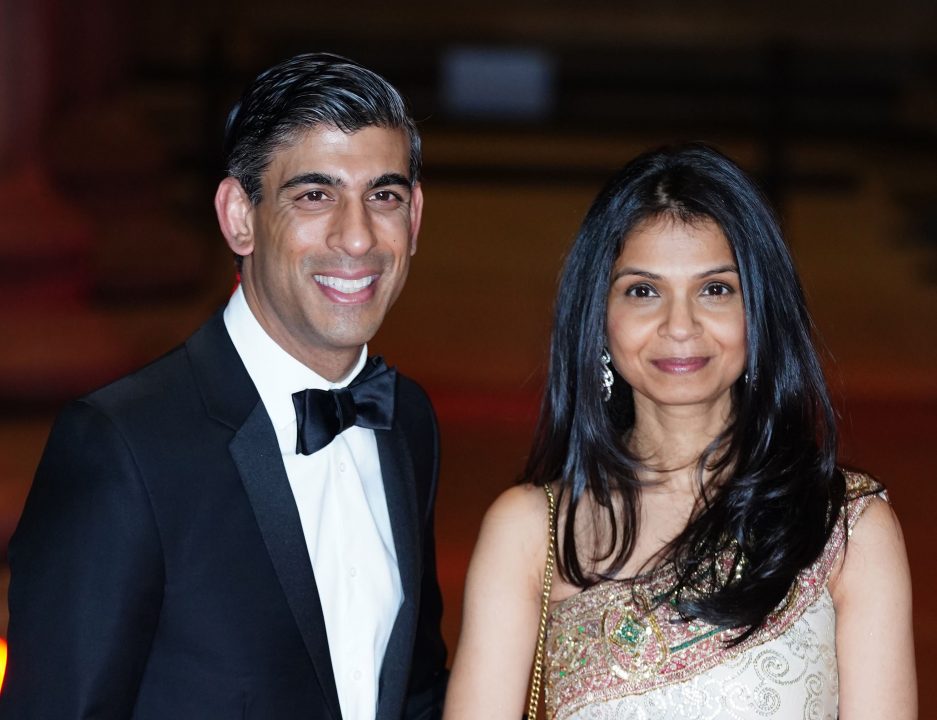

The row over Rishi Sunak and his family’s tax situation has shown how the Chancellor and his wife are in a “completely different universe in financial terms” from ordinary people left struggling by the cost-of-living crisis, Nicola Sturgeon has said.

The First Minister said revelations about his wife’s finances had left Sunak in a “very, very difficult” position.

The SNP leader spoke out after Akshata Murty, who is an Indian citizen, announced on Friday that she would pay UK taxes on all her worldwide income as she did not want her financial arrangements to be a “distraction” for her husband.

Ms Murty, who is estimated to be worth hundreds of millions of pounds, has non-domiciled status, which has exempted her from paying tax in the UK on foreign earnings.

Labour and the Liberal Democrats are now pressing for the millionairess to pay the back taxes she had saved through not having to pay UK taxes on her overseas income.

Speaking about the Chancellor, Sturgeon claimed: “As he puts taxes up on ordinary people already struggling his own family is not paying tax on millions of pounds of earnings.”

And she stated: “I think the Chancellor’s position is very, very difficult right now.”

She said that prior to the revelations “most people across the country would have seen Rishi Sunak as being out of touch”, attacking the Tory for having “completely failed to step up and provide the kind of help with the worst cost-of-living crisis any of us can remember that people would have expected a chancellor to do”.

The First Minister, speaking as she campaigned in Glasgow in the run-up to next months council elections, added: “What we have heard in the last few days will leave people angry and perplexed.

“He’s tried to suggest the non-domiciled status of his wife is somehow an automatic consequence of the fact she is an Indian national, when in actual fact, as I think has now been established, it is something she has chosen, applied for, paid tens of thousands of pounds in order to secure and resulted in a situation where as he puts taxes up on ordinary people already struggling his own family is not paying tax on millions of pounds of earnings.

“I think that is something at the best of times people would struggle (with) and the ‘it’s within the letter of the law’ explanation I suspect makes people feel even angrier.

“This is a time when people are finding it really difficult to heat their homes and feed their children and they see a Chancellor who just occupies a completely different universe in financial terms.”

It has been estimated that Ms Murty, a fashion designer and the daughter of an Indian billionaire, potentially saved up to £20m in UK tax through her non-domiciled status.

She is reported to hold a 0.91% stake in Infosys, an IT business founded by her father, and has received £11.6m in dividends from the Indian firm in the past year.

Non-dom status means she would not have to pay UK tax at a rate of 39.35% on dividends.

India sets the rate for non-residents at 20%, but this can fall to 10% for those who are eligible to benefit from the UK’s tax treaty with India.

Labour has also questioned whether she would use her Indian citizenship and a treaty with the UK dating back to the 1950s to avoid paying inheritance tax – a move which could reportedly save tens of millions of pounds.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

PA Media

PA Media