Thousands more workers moved to Scotland than left since the nation became the highest taxed part of the UK, research by HMRC has found.

The study found there was “no evidence of changes in labour market participation” following tax rises in 2017 that saw Scotland begin to diverge from the rest of the union.

HMRC found that in the 2021-22 tax year, Scotland benefited from a £200m surplus in taxable income from Brits from the rest of the UK.

However, the research found “some limited evidence of a decrease in net cross-border migration” for Scottish taxpayers above the Higher rate threshold following the Scottish income tax changes.

The research, commissioned by the Scottish and Welsh governments, tracks migration throughout the UK through different income levels from 2009 to 2022.

It examines what impact the Scottish Government’s tax rises in 2018 had on workers entering and leaving Scotland.

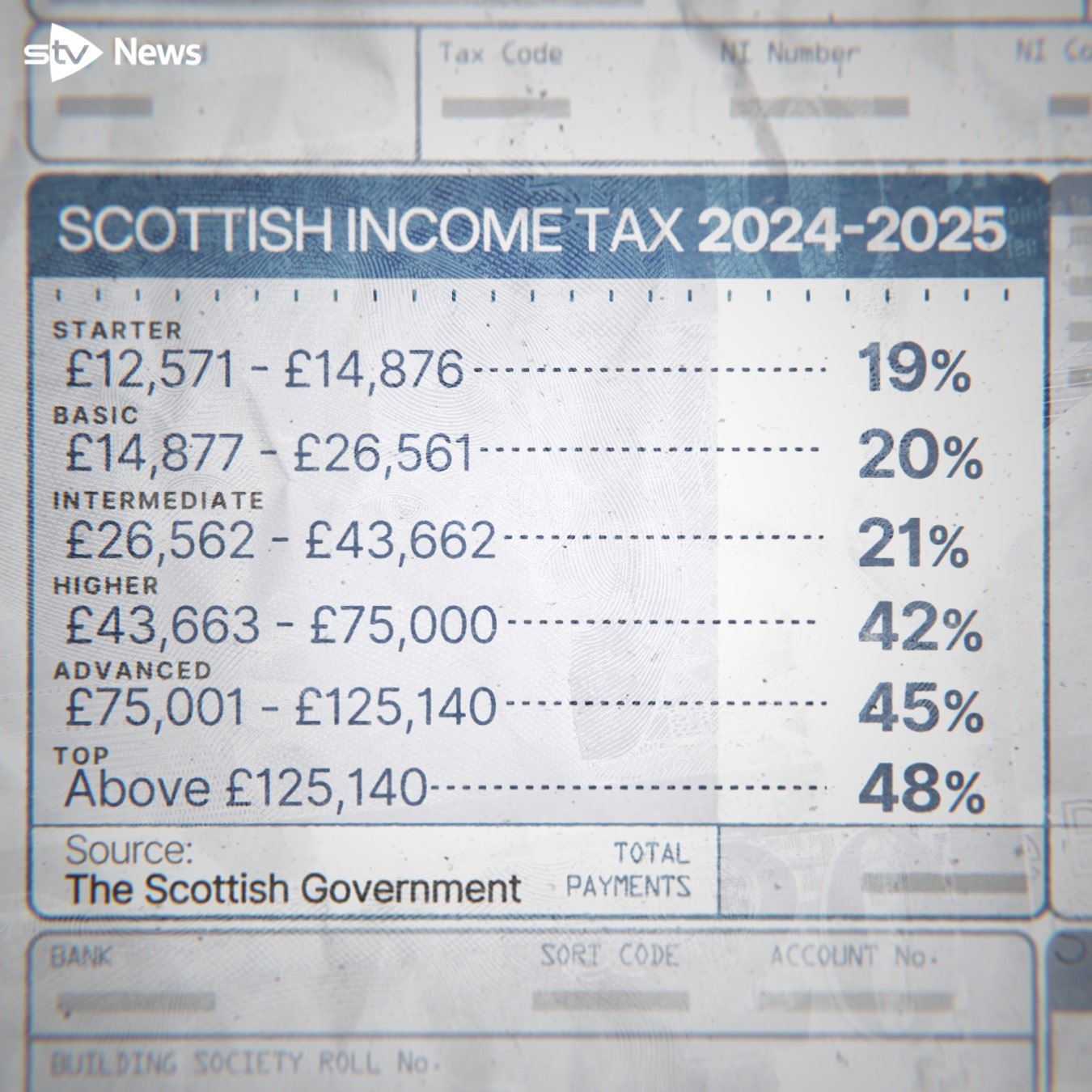

Scottish income tax was devolved in 2016 and since then ministers at Holyrood have increased tax on middle and higher earners, including by freezing the threshold of some bands, creating new bands and raising existing bands.

The study does not examine the tax rises in the latest Scottish Budget announced in December.

Currently, people in Scotland begin paying more tax after earning about £28,000 (around £10 a year) while that number rises to £1,542 for those on £50,000 a year and goes all the way to nearly £6,000 for those on salaries of £150,000.

The Scottish Conservatives have voiced concerns that the rises could lead to higher earners leaving Scotland.

HMRC found a gradual increase in net migration of taxpayers to both Scotland and Wales from the rest of the UK from 2016 to 2017 with even larger upticks in the years after.

But there was “some evidence of a fall in net migration to Scotland for individuals earning over the higher rate threshold with the size of the fall increasing with income levels”.

Researchers found that net migration from the rest of the UK to Scotland was around 1,500 between 2011 and 2017 but soared to around 8,000 a year by the end of 2022.

HMRC said: “This deviation from the generally stable trend reflects decreasing numbers of taxpayers migrating from Scotland to [the rest of the] UK combined with an increase in migration to Scotland in the year ending 2022.

“Overall, net migration to Scotland was positive in nine out of the 12 years covered in the dataset.

“The net income movement (the amount of taxable income earned by individuals migrating from rUK to Scotland minus the amount of income earned by individuals migrating from Scotland to rUK) was at a deficit between tax year ending 2011 and year ending 2019, averaging around -£60m, and increased thereafter towards a surplus of around £200m.”

STV News

STV NewsThe deputy first minister said the research showed Scotland is an attractive place to live and work despite tax rises.

Shona Robison said: “We welcome this research, showing a steady increase in net taxpayer migration in the years after Scottish income tax was introduced.

“The latest figures show that across all tax bands and almost all age ranges in 2021-22, more taxpayers chose Scotland as their home than left – offering yet more proof that Scotland is an attractive place for people to live and work, while our progressive approach to income tax asks those who earn more to contribute some more.

“We know people base the decision on where to live on a range of factors, and by coming to Scotland they have access to a range of services and benefits not available elsewhere in the UK, including free tuition and prescriptions.”

Scottish Conservative shadow finance secretary Liz Smith MSP said: “This is desperate SNP spin and cherry-picking based on a single year, long before the tax gap was significantly widened.

“The study specifically says it can’t ‘draw definitive conclusions’ about workers’ movement. It warns that increased rates could have a significant impact but that obviously does not fit the SNP’s narrative.

“And it predates the SNP’s devastating recent tax-and-axe budget, which has been widely viewed as the tipping point in the growing tax gap between Scotland and the rest of the UK.

“Virtually every business group has identified that tax gulf as a serious disincentive, which will hold back the economic growth essential to fund public services. They were clear that the current levels, not addressed by this report, were actively impacting on Scotland’s ability to recruit and retain key workers.

“Groups like the British Medical Association, the British Dental Association and, just the other day, government-owned Prestwick Airport have also warned that it is becoming harder and harder to recruit and retain skilled workers.

“Rather than burying their heads in the sand and twisting the facts, SNP ministers need to act now, to end Scotland’s status as the highest taxed part of the UK.”

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

STV News

STV News