Around 30 million people will see the pay they take home each month rise when changes to National Insurance contributions take effect on Wednesday.

Chancellor Rishi Sunak announced the £6bn plan back in March after acknowledging the impact of inflation and the global economic uncertainty caused by Russia’s invasion of Ukraine.

STV News takes a look at what the threshold change means for you.

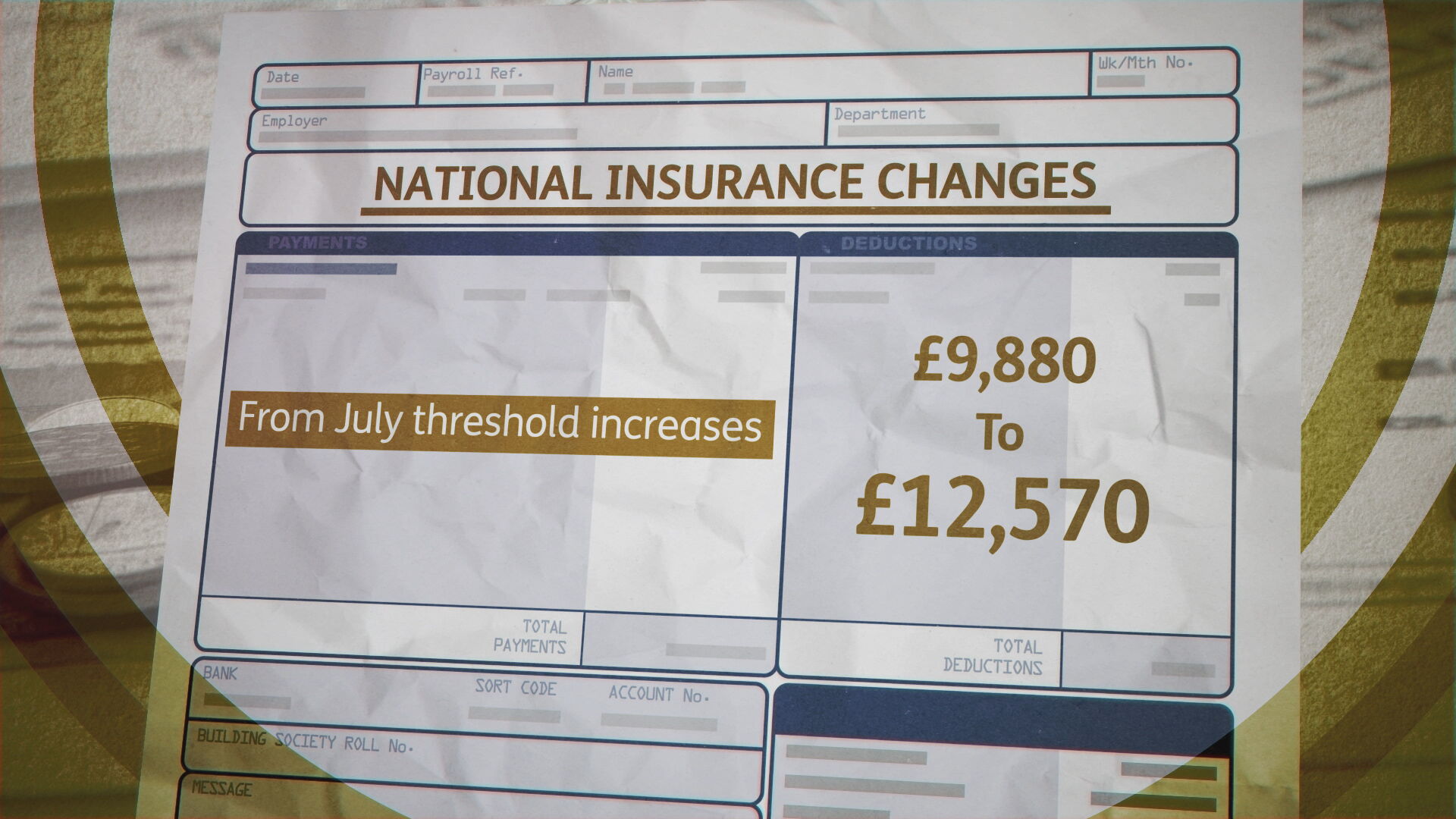

What do I now need to earn before I start paying National Insurance?

Employees currently pay national insurance contributions (NICs) on annual earnings above £9880 but the threshold increases to £12,570 from Wednesday.

The change will save some 30 million British workers up to £330 a year.

STV News

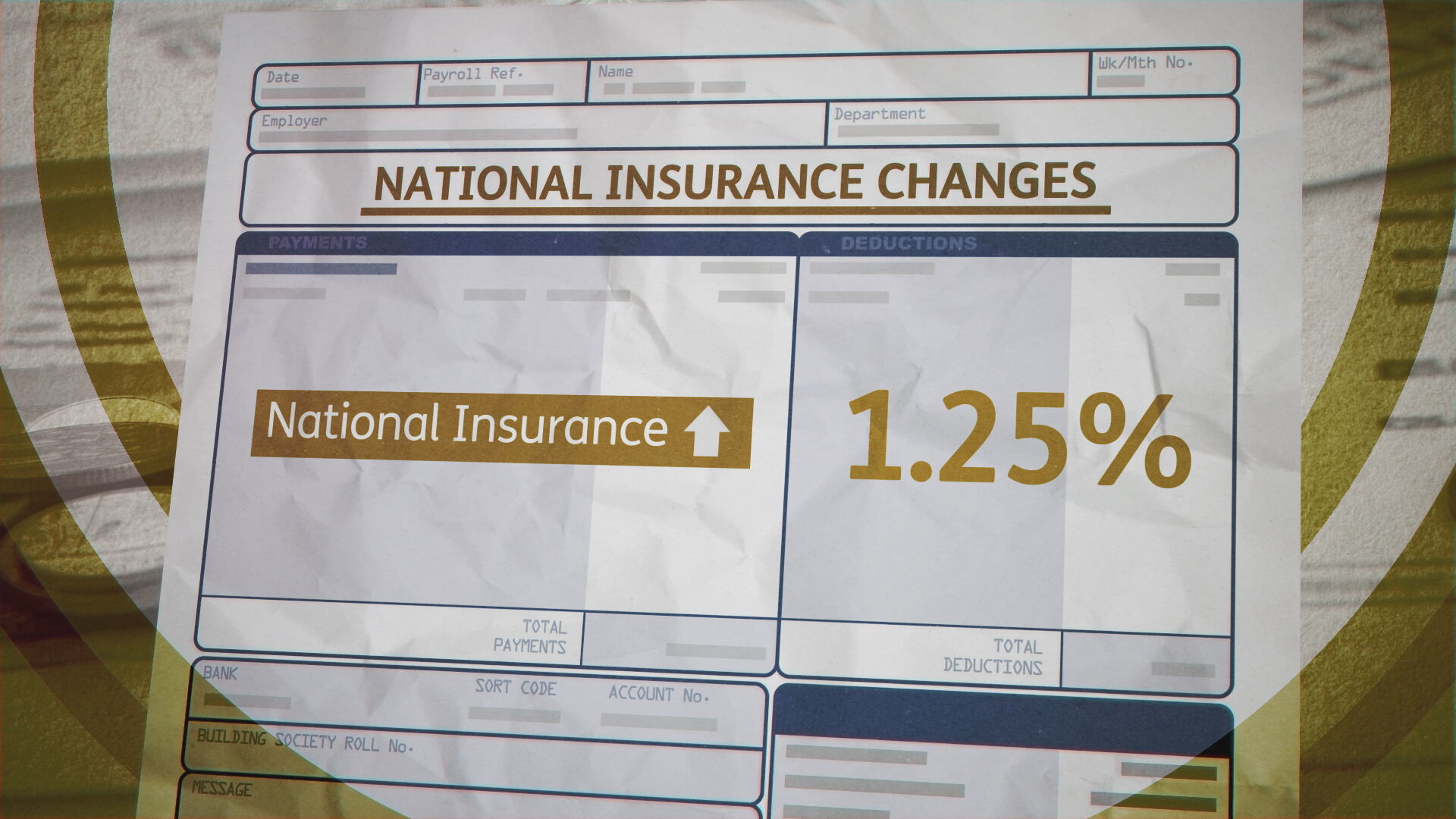

STV NewsFor many, it also reverses the impact of the 1.25 per cent National Insurance rise to introduced in April, which was a one-year levy to fund social care.

Anyone earning less than around £35,000 will see their pay packet return to roughly the same level it was before April.

Of those who benefit from the threshold increase, 2.2 million people will be taken out of paying NICs altogether, according to the UK Government.

Laura Suter, head of personal finance at AJ Bell, said: “From July 6, millions of people will see their national insurance bills cut, as the threshold at which people start paying the tax is raised to £12,570.

“The move means that most people on an annual salary of up to £12,570 will pay no income tax and no national insurance.”

Ms Suter added: “The (UK) Government has heralded July’s change as a cut in tax, that will save the average worker £330 a year, but millions of people will actually be paying hundreds of pounds more in taxes when compared to the previous system.”

Why is the change needed?

Fears are continuing to mount that the cost-of-living crisis could tip the UK into recession, as defined by two quarters in a row of falling output, as rocketing inflation sees households and businesses rein in spending.

Inflation has already reached a 40-year high of 9.1% and is set to rise past 11% in the autumn.

Bank of England Governor Andrew Bailey said on Wednesday that soaring inflation will hit Britain harder than any other major economy during the current energy crisis and that output is likely to weaken earlier and be more intense than others.

UK Parliament TV

UK Parliament TVPrime Minister Boris Johnson and Chancellor Rishi Sunak penned a joint article earlier this week to outline what they are calling “the single biggest tax cut in a decade” in a show of unity on the cost-of-living crisis.

They said the cut will amount to £6bn in value and lift 2.2 million people out of paying “any National Insurance or income tax on their earnings at all”, with “around 70% of British workers” paying less National Insurance.

Why did National Insurance rise earlier this year?

UK Government ministers say the plan to increase National Insurance contributions by 1.25% earlier this year was needed as a levy to fund social care.

STV News

STV NewsSince that April hike, employees have paid 13.25 per cent in contributions on any earnings between £9,880 and £50,000, and 3.25 per cent on everything over £50,000.

The Scottish Government said it was committed to passing on all funding received from the NI change to health services in Scotland.

Jump in people paying higher rates of tax

New HM Revenue and Customs (HMRC) figures showed that some 6.1 million taxpayers are projected to be paying income tax rates at the higher rate of 40% or the additional rate of 45% in 2022/23.

The figures also show two million higher and additional rate taxpayers have been created in the space of three years.

iStock

iStockSir Steve Webb, a former Liberal Democrat pensions minister who is now a partner at consultants LCP (Lane Clark & Peacock) said: “Paying higher rate tax used to be reserved for the very wealthiest, but this has changed very dramatically in recent years.

“The starting point for higher rate tax has not kept pace with rising incomes, and the current five-year freeze on thresholds has turbo-charged this trend.

“People who would not think of themselves as being particularly rich can now easily face an income tax rate of 40% and around one in five of all taxpayers will soon be in the higher rate bracket.”

Will the threshold change have much impact when everything else is getting more expensive?

The change will be welcome relief for many but it comes as the cost of living crisis is intensifying, with the price of food, fuel and other essential items all rising at a rapid pace.

Food has increased by a massive 8.7%, with bread, cereals, meat, oil and fats seeing the largest increases.

From April 2021 to April 2022, the price of pasta had increased by 50%, crisps by 17%, bread and minced beef by 16% and rice by 15%.

The cost of filling up a family car with petrol last month is also around 30.4% higher than a year ago. Furthermore, the UK’s energy price cap increased by 54% in April and 22 million customers saw their payments skyrocket.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

iStock

iStock