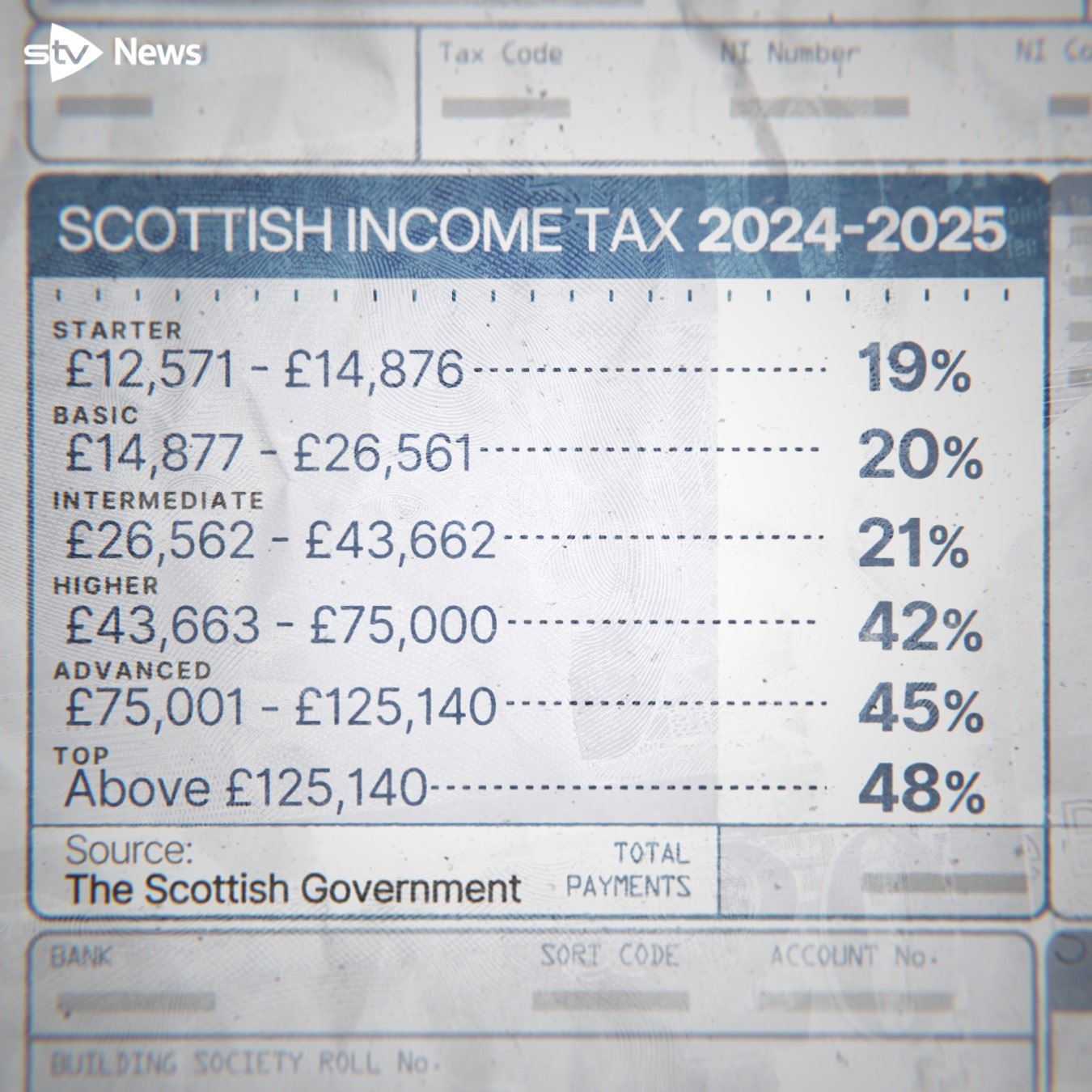

Scotland’s finance secretary has announced a new tax band for higher earners as she delivers the budget for the year ahead.

Shona Robison said there would be a 45% “advanced” rate introduced on earnings between £75,000 and £125,140.

The top rate for those earning over £125,140 will increase by 1p to 48p in the pound.

These two decisions should raise around £82m, according to the Scottish Government.

It means Scotland will have six tax bands while England has three.

What does the budget mean for you?

STV News

STV News- Anyone earning more than £75,000 will pay more in tax

- The 42% income tax threshold for earnings above £43,663 won’t rise with inflation

- This means that more middle earners will pay the higher rate

- People earning below £43,000 should not pay any more in tax

- Council tax should remain frozen across Scotland next year

- All Scottish benefits will rise with inflation

- Scottish Child Payments will rise to £26.70 from April next year

- School meal debt for children will be wiped as ministers provide councils with a £1.5m fund

- Business rates for premises valued at less than £51,000 will be frozen while island hospitality businesses will be given 100% relief

In total the tax changes will bring in another £1.5bn to Scotland’s finances next year, Robison said.

How does Scotland differ from the rest of the UK?

The move to tax higher earners more – which was previously reported – has been criticised by Prime Minister Rishi Sunak as “disappointing”.

Scotland is already the highest taxed part of the UK, with those earning more than £50,000 paying around £1,500 more a year than those in other parts of Britain before Tuesday’s budget.

The deputy FM said it was fair that those with the broadest shoulders pay more as the Scottish Government tries to avoid cutting public services.

People with earnings over £28,850 in Scotland, slightly above median earnings, pay more income tax than they would in the UK, according to the Scottish Fiscal Commission.

The latest policy decisions widen the gap further for those earning over £75,000 (the top 5% of taxpayers).

Scottish Government changes to income tax policy since 2017 mean someone in Scotland earning £100,000 will now pay £3,346 more in income tax than they would in the rest of the UK.

The Scottish Conservatives shadow finance secretary Liz Smith said: “Under the SNP, Scotland was already the highest taxed part of the UK – and the income tax rises announced by Shona Robison have only widened that gap and increased the burden on hard-working Scots.

“They mean that 100,000 more Scots are now paying the higher rate of tax.”

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country