Homeowners fighting for compensation after being tied into 25-year loans under a scrapped Green Deal scheme are demanding a blanket cancellation of their solar panel contracts.

Customers of Scottish firm Helms (Home Energy and Lifestyle Management Ltd), which went bust almost a decade ago, claim they’ve been left with the legacy of mis-selling.

Without any professional legal support, groups in Glasgow, Lanarkshire and Ayrshire have been waiting to present their cases to a tribunal – a complex process that has been fraught with delays.

Many of those affected say they feel abandoned after being left with faulty systems, multi-year loans and no clear route to justice.

Some homeowners have been fighting for over a decade to get answers, but they are caught in a complex appeals process and seeking redress for loans they say should never have been approved.

‘I can’t sell my house’

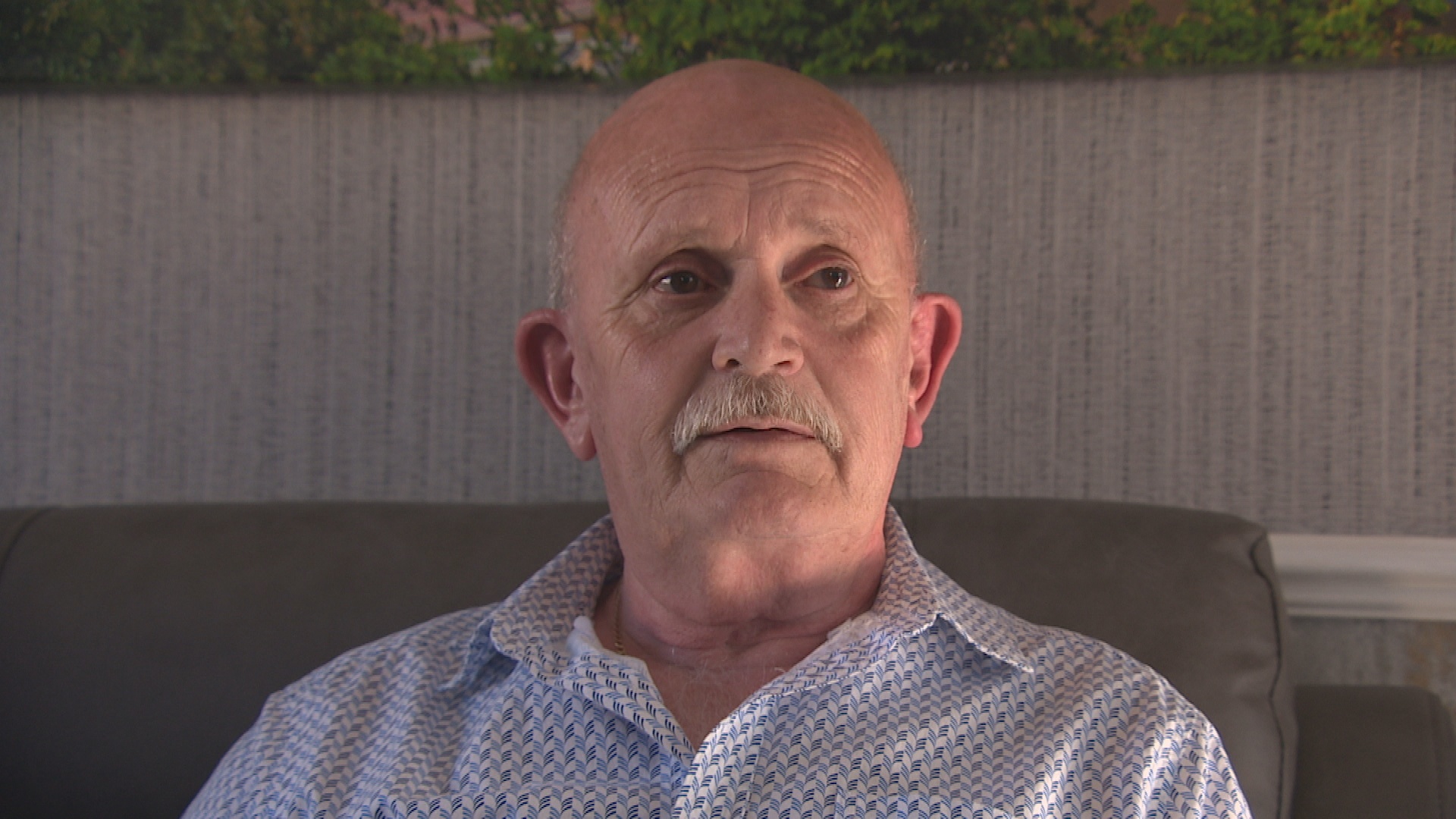

Jim McColl, a retired TV technician from Blantyre, was cold-called by Helms in 2013. The 68-year-old signed up for solar panels and underfloor insulation.

STV News

STV News“We want to move to a bungalow due to health issues, but I can’t sell the house,” he told STV News. “No-one wants the burden of this contract.”

Jim says he was offered £500 to walk away from his claim.

“I was livid. After everything we’ve been through? I feel totally abandoned by everybody that was supposed to protect us.”

Jim’s wife suffered a heart attack last year, which he believes was brought on by the stress of the ordeal.

“I’m not doing this for money. I just want the burden lifted, especially for my wife,” he said. “I just want it finished so we can go on with what’s left of our lives.”

‘Biggest regret of my life’

Eugene O’Brien, 75, bought his home in 2012. Soon after, he signed up to a Green Deal offer from Helms.

More than a decade on, he’s preparing for a second-tier tribunal appeal – one of up to 15 cases being considered.

STV News

STV News“When Helms went bust, I had the panels checked,” said O’Brien. “The engineer told me: ‘You can fill the kettle today and it might be boiled next Christmas.’ That’s how little energy they were generating.”

Like hundreds of Helms customers back in 2013, Eugene says he was given a promise that the solar panels and improvements to his home would lower his energy bills at no extra cost.

He was also told that it was all backed by the UK Government.

This form of the green deal was scrapped two years later. Helms was fined for its sales tactics and when the firm went bust in 2016, Eugene had the solar panels checked.

The readings from his consumer unit were faulty from the start. Fixing the system cost him £1,500 – money he believes he never should have had to spend.

“It’s disgusting that it has dragged on this long,” he told STV News. “Green Deal is punishing us for their mistake. I just want it ended, one way or another. There should be refunds. The scheme should be scrapped.”

‘I’m still fighting’

Shirley Buchanan, from the Balornock area of Glasgow, signed up to the scheme in 2012 and is now locked into a 25-year loan.

She claims she was tied to a finance deal she knew nothing about, left with debt and paying more for electricity. This is the second time she has taken her complaint to a tribunal.

“It just makes me angry – angry at Helms and angry at myself,” said the 76-year-old.

“It’s hard to navigate all this legal stuff. You feel like you’re fighting half the world.”

STV News

STV NewsDespite suffering two heart attacks, she’s continuing the fight and will give evidence in person at the tribunal.

She said: “They need to see the faces of the people this is affecting. I’m not getting any younger, and this has taken its toll.

“It is difficult to navigate when you don’t have the knowledge as most of it is legal stuff. I am still trying to fight it.

“But at times it feels like you are trying to fight against half the world. You don’t have the knowledge.

“If you let it get you down too much, you would just give in, so you have to keep fighting and hoping you get a better result next time.”

‘We feel abandoned’

Eugene and Shirley were both unable to insure their homes as the work was carried out without building warrants.

The community action group worked with politicians and Glasgow City Council to ensure that was rectifed in 2020.

Securing the win was enough for some to walk away from pursuing complaints. Others plan to continue, despite the lack of professional legal help.

Angela Lowe never imagined she’d be helping neighbours prepare tribunal evidence, but that’s what she’s doing now.

“We’ve had to go through 70-page legal documents ourselves,” she told STV News. “We’re not lawyers, we’re just people trying to get this sorted.”

STV News

STV NewsAngela works in finance and says the Financial Conduct Authority should have had oversight.

“If this had been FCA-regulated, it wouldn’t have been allowed to drag on for ten years,” she said.

She also shared stories of neighbours who have died before seeing justice, leaving families to resolve complex estates.

Campaigner confronted Helms owner

Irene Harris from Kilmarnock has led the action group in Ayrshire, helping others in her area and beyond navigate the complex complaint system.

STV News

STV NewsA Helms customer herself, the 72-year-old campaigned on the issue at Holyrood and Westminster and even confronted then Helms’ owner Robert Skillen on Scotland Tonight in a heated debate in 2018.

She told Mr Skillen that she had sleepless nights and the stress had damaged her health.

The businessman claims that he has done nothing wrong – putting the blame on the UK government – and at that time offered to hand over his entire £10m fortune if anyone can disprove his claim.

Irene is not at the tribunal stage but has submitted a complaint and is waiting to start the process.

No answers yet

September is now the latest date that has been set for the hearings.

A spokesperson for the Department for Energy Security and Net Zero told STV News: “The Green Deal issued loans from 2013 to 2019. We are investigating all complaints referred to the department on this inherited scheme to resolve them as quickly as possible.”

However, the department has so far not provided updates on how many complaints are under review, or how many contracts – if any – have been cancelled.

In Lanarkshire, no agreements have been secured around retrospective building warrants, and as the 25-year loan is attached to the home, rather than the person applying, it makes selling a property difficult.

The Green Deal Finance Company (GDFC), which took over the loan book in 2017 and relaunched the scheme, received over 480 complaints.

STV News

STV NewsRepeated requests for comment from GDFC, a subsidiary of Tandem Money Limited, have gone unanswered.

A spokesperson for Tandem Money Limited, said: “We are aware of a small number of historic complaints by Green Deal customers.

“These are being processed by the Department of Energy Security and Net Zero on a case-by-case basis and GDFC remains committed to providing any assistance the Department requires.”

As second-tier tribunal appeals move forward, those involved say their only hope is for accountability and closure.

“There needs to be refunds,” says O’Brien. “This never should have been allowed to happen.”

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country