In Rothesay on the Isle of Bute, the last bank has closed its doors, leaving an island of over 6,000 people without a single branch.

It’s a story playing out in towns and villages across Scotland. Since 2015, Bank of Scotland has closed 187 branches, and Royal Bank of Scotland has shut 183. In the next 12 months, a further 147 bank branches are set to close their doors.

For businesses like Isle of Bute Distillery, the closures have forced tough decisions, including no longer accepting cash.

WATCH: Scotland Tonight: Should We Trash Cash? on STV Player

STV News

STV NewsBute Yard Manager Iona Buick says their decision to go card-only wasn’t a matter of preference, but of practicality and safety.

She told Scotland Tonight: “When we were a smaller business, we accepted cash. But once we moved to a bigger venue, it meant travelling to the mainland every week, sometimes once or even twice a week, to deposit large sums.

“It cost us £100-200 each time just to deposit our cash… and it was obviously risky for staff to be travelling with large sums of money all that way.

Key facts

-

Scotland has experienced the highest rate of bank closures in the UK

Scotland has experienced the highest rate of bank closures in the UK -

More than 60% of bank branches have shut down over a nine-year period

More than 60% of bank branches have shut down over a nine-year period -

More people than ever are using mobile wallets, banking apps and contactless to make everyday purchases

More people than ever are using mobile wallets, banking apps and contactless to make everyday purchases -

The Covid pandemic accelerated the shift – with hygiene fears seeing retailers and consumers move away from notes and coins

The Covid pandemic accelerated the shift – with hygiene fears seeing retailers and consumers move away from notes and coins -

Two in three Scots favour contactless over cash, with nearly one in three never carrying cash

Two in three Scots favour contactless over cash, with nearly one in three never carrying cash -

But 48% of respondents to a Scottish Affairs Committtee survey said they ‘often’ use cash

But 48% of respondents to a Scottish Affairs Committtee survey said they ‘often’ use cash -

Only 4% said they never use cash – suggesting it still plays a role for a significant number of Scots

Only 4% said they never use cash – suggesting it still plays a role for a significant number of Scots -

The total value of Scottish banknotes in circulation has fallen to its lowest level since November 2020 – four times faster than the rate of English notes

The total value of Scottish banknotes in circulation has fallen to its lowest level since November 2020 – four times faster than the rate of English notes -

The UK Government said businesses will not be compelled to accept cash

The UK Government said businesses will not be compelled to accept cash -

But the Financial Conduct Authority requires banks to maintain ATMs, banking hubs, and other services in communities

But the Financial Conduct Authority requires banks to maintain ATMs, banking hubs, and other services in communities

“We never had a branch that we could bank with on the island, and we tried to open a new account but because of an issue with our address, we couldn’t open a new account locally.

“We also tried to get a cash card at the Post Office, but we weren’t able to do that either.

“In the end, we had to decide whether it was practical and sustainable to keep taking cash or just try to be more card-only.”

It’s a growing trend, and for some, a growing concern.

Rothesay is about to see a new type of banking solution open in the form of a Banking Hub – a shared space operated by the Post Office, where major banks send staff on different days of the week to provide in-person support.

‘It’s absolutely critical we protect cash access’

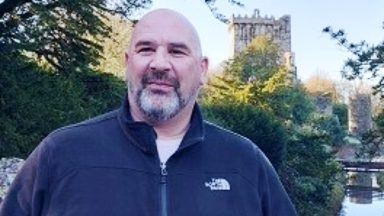

STV News

STV NewsNick Quinn, head of financial inclusion at LINK, says hubs are designed to ensure people who still rely on cash, particularly older or financially vulnerable individuals, aren’t left behind.

“We know many people now bank digitally – through apps, phones, even smartwatches – and that’s driving bank branch closures. But it’s absolutely critical we protect cash access, especially in rural and low-income communities. That’s why we look at every closure and ask what that area needs.

“There are now 150 banking hubs open across the UK, we’ve recommended 30 across Scotland, and people are finding them to offer a really good service. And if you think about it, when your last bank closes, and a banking hub opens, suddenly you have access to banking services no matter who you bank with.”

Across the UK, the majority of adults now use online or remote banking, with most using mobile apps. But research suggests nearly one in five people who bank online say they would still rather do it in person.

STV News

STV NewsIn Edinburgh, ACE IT Scotland runs classes to help people over 50 improve their digital confidence, including banking online.

For many of the older learners, the shift towards a digital-only system isn’t just an inconvenience, it’s an exclusion.

ACE IT educator Linda explains: “We have seen more people coming forward concerned about how they can access their bank account, usually because their local bank branch is closing, and they have been asked to go online.

“That has a multitude of problems for the individual, not only because they perhaps lack the digital skills, but also because they may be living in digital poverty. They need to have broadband, or pay for data, and for some people, that can be really difficult.

“And then in terms of accessing the device, if they are elderly, it may be that they are living with a health condition like a visual impairment, and they need help to make their device more accessible or if there is a mobility issue, maybe they can’t hold a device and they need help with how to adapt that way as well.”

‘I will never bank online again after losing £8,000’

STV News

STV NewsCybercrime is also a growing concern, with many participants citing fear of scams and fraud as a reason for sticking with cash.

“I will never bank online,” one woman told Scotland Tonight. “I already tried it and I was hacked. I lost £8,000.

“I got it back from the bank because I reported it straight away and they believed me, fortunately – but I’m very scared of it now. if they forced me to, I am simply going to take all my money and store it in the house.”

In April, the UK Treasury Committee issued a strongly worded report urging the government to protect cash as a vital service.

It called for stronger oversight of bank closures, more support for shared hubs, and a recognition that for millions, cash remains not a choice, but a necessity.

“The digital shift brings huge benefits,” the Committee reported. “But there must be no communities or individuals left behind.”

John Grady MP, a member of the Treasury Committee, said: “If this trajectory continues, my own view is the UK Government would need to seriously consider intervention. There are a number of reasons for that, including potentially excluding vulnerable individuals that we want to protect, but here is also the question of resilience.

“We can’t have banking outages, and the UK banking regulator is in regular dialogue with the banks about that, and there’s also cyber-attacks and the national resilience, and that’s why internationally we do see other countries legislating to protect access to cash.”

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country